The worst drought in the United States in more than half a century poses widespread crop failures in most of the nation’s agricultural states and a spike in the cost of staple grains worldwide. With a record 1,300 counties now officially declared disaster areas and more than two-thirds of the country stricken by drought, the situation is comparable to 1934 and 1936—the worst years of the Dust Bowl.

The US is by far the world’s largest producer of corn, soybeans and wheat, meaning that the disaster bears a direct impact on importing countries from the Caribbean to Asia, the Middle East and Africa.

The US is by far the world’s largest producer of corn, soybeans and wheat, meaning that the disaster bears a direct impact on importing countries from the Caribbean to Asia, the Middle East and Africa.

A frenzy of speculation on plummeting crop yields has pushed corn and soybean prices past previous records set in 2008, when food riots erupted in more than 30 countries. The inflation of that year was driven by a confluence of weather disasters and the massive entry of traders into the commodities markets away from collapsing finance stocks. The result was 1 billion more people suffering hunger and 100 million more pushed into absolute poverty.

On Thursday, soybeans bound for August delivery rose to a record $17.49 a bushel. Wheat for September rose to $9.35, the highest since 2008. Corn for September delivery broke its previous record at $8.16 a bushel, as future yield estimates were cut by as much as 15 percent.

Global food organizations are raising concerns about the impact of the new price rises on top of the devastation already wrought by economic crisis on the most vulnerable populations. “Large numbers of people live very close to the edge,” Save the Children head Justin Forsyth told the Financial Times Thursday. “Failed rains and high food prices have tipped lots of people over the edge from being able to cope to not being able to cope.”

José Graziano da Silva, the UN’s Food and Agriculture Organization director echoed the warning: “I am certainly concerned about the recent rises in food commodity prices, given their potential implications especially for the vulnerable and the poor, who spend as much as 75 percent of their income on food.”

Grain suppliers have begun defaulting on already agreed-upon sales to importing countries, including Egypt and Libya. The disjointed and chaotic global food distribution system poses its own problems to import-dependent populations. Congestion in Indian ports has reportedly delayed corn and rice shipments to Africa and Asia by up to 25 days. The backup threatens to be further compounded by the onset of the monsoon season once vessels are Southeast Asia-bound.

“I’ve been in the business more than 30 years and this is by far and away the most serious weather issue and supply and demand problem that I have seen by a mile,” an unnamed senior executive at a trading house was quoted by the Financial Times. “It’s not even comparable to 2007-2008.”

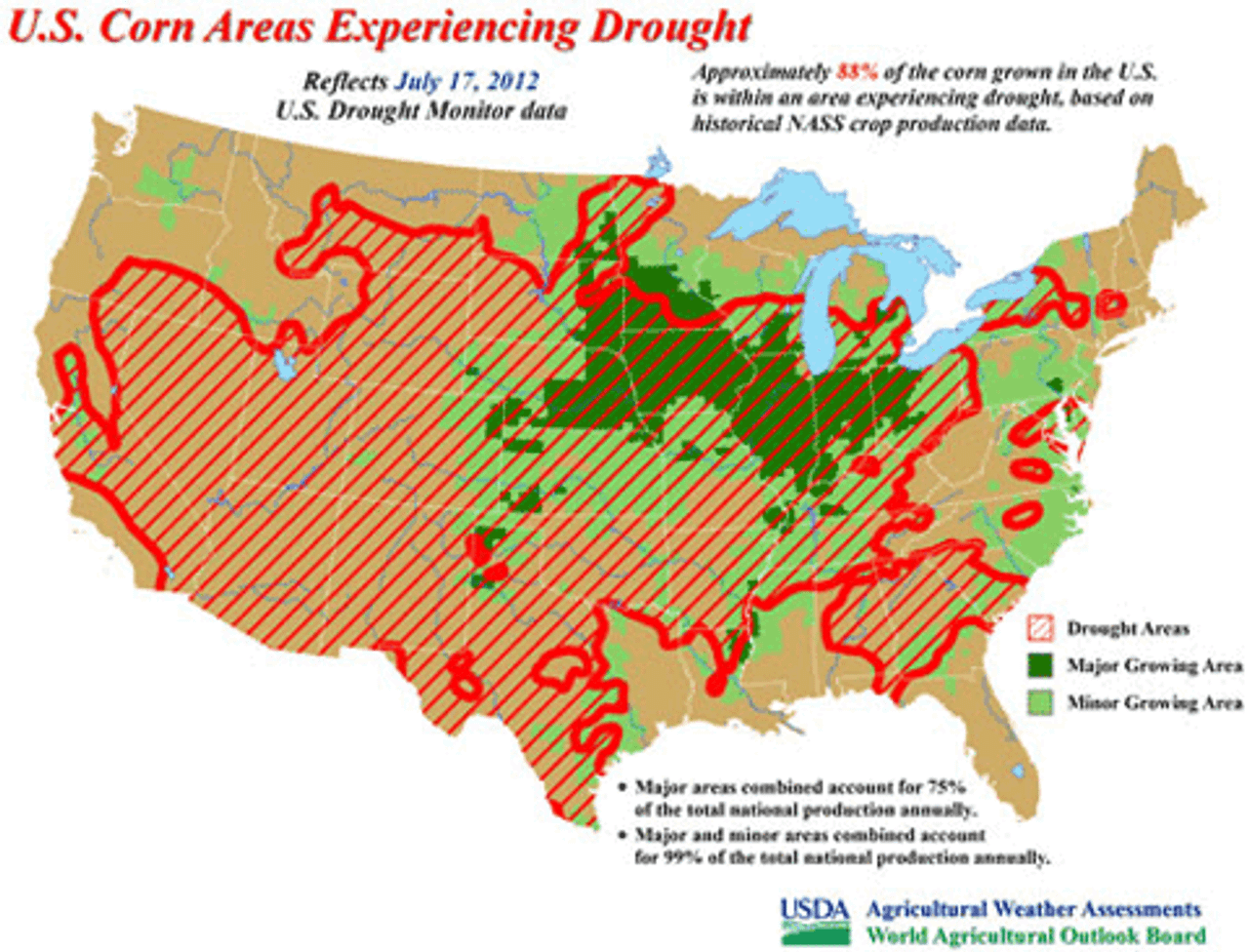

The tight supplies and lower future estimates have fueled a rally on grain stocks. Stockbrokers at the Chicago Board of Trade have said corn prices could swell above $9 by early August if the high heat and dry spell continues as meteorologists forecast. As of July 17, more than 70 percent of the corn belt was under moderate or severe drought, up from 63 percent the week before.

The National Oceanic and Atmospheric Administration’s Climate Prediction Center warned on July 19 that the drought could last past October. “There’s a greater chance that there is no relief possible or in sight,” NOAA meteorologist Dan Collins said. Through June, 2012 has been the hottest year on record in the US.

Worldwide, last month’s land temperatures were the warmest ever recorded. The unprecedented heat and recent extreme weather events are in line with projections issued by scientists over the past several decades, indicating the impact of global warming on the earth’s climate.

“The soil moisture in Iowa is pretty much gone so there’s not much to keep crops going,” Iowa climatologist Harry Hillaker said. Iowa is the nation’s largest producer of both corn and soybeans.

The blight is spreading swiftly. The entire southern half of the state is now designated as in “severe drought” by the federal Drought Monitor. Nationwide, the Drought Monitor reported 88 percent of corn crops and 87 percent of soybean crops were in drought-stricken regions—up ten percent from last week.

Because much of the corn crop withered during its critical pollination stage in the past few weeks, Hillaker explained, “Even if temperatures went down five degrees and rainfall increased 50 percent for the rest of this month, it might slow the rate of decline but it’s not going to reverse the decline in crop conditions and the ultimate yield. There’s not much left of the corn belt that’s in good shape.”

Livestock producers, facing the liquidation of their herds for lack of pastures, have asked the White House to suspend the federal mandate on corn-based ethanol fuel additives in order to ease the cost of feed corn. In addition to the feed shortages, many livestock farms are also confronted by critical shortages of water. A record 54 percent of pastures and rangeland is listed in poor to very poor condition. Livestock producers are not protected against losses by USDA insurance.

A joint statement from national chicken, cattle, dairy and pork producers to the Obama administration cautioned that “another short corn crop would be extremely devastating to the animal agriculture industry, food makers and foodservice providers.” As a result, supermarket meat, dairy, and egg prices are likely to spiral upward dramatically next year.

The American Council for Ethanol, which is protected against a corn shortfall through the federal mandate and is opposed to government intervention in the crisis, declared that the food producers “feel entitled to cheap corn forever.”

The US Department of Agriculture, which has steadily reduced its crop condition and production estimates, has sought to reassure farmers that they will be compensated for their losses. The Obama administration has done little, however, to prevent the market glut or the coming inflationary spike in consumer prices.

USDA director Tom Vilsack declared at a White House press conference Wednesday that he would “pray” for ruined farmers. “I get on my knees every day,” he said. “And I’m saying an extra prayer now. If I had a rain prayer or a rain dance I could do, I would do it.”

In an interview on American Public Media’s radio show “Marketplace” the following day, Vilsack was asked whether the government acknowledged that the unprecedented weather was indicative of climate change. “Well, I’m not an expert on climate change,” he demurred, “so it probably wouldn’t be appropriate for me to respond specifically to that question.” The focus of the government, he insisted, was to “help these folks, making sure, for example, that people know that they got to contact their insurance agent, if they have crop insurance, that they may have a damaged crop so that they won’t lose rights under their policy, that’s our focus.”

A serious attempt to aid the millions of people affected by the drought would require a massive re-investment in infrastructure—including irrigation and river systems, wildfire response, pollution control, and land conservancy programs—and a reorganization of all sectors of the economy, including energy and agricultural production to mitigate the affects of climate change. In fact, the government’s “focus” in regard to environmental disasters has been to systematically obscure the impact of global warming and its relation to the political and economic system.

While political officials make maudlin appeals to religion and feign ignorance about the global environmental crisis, venture capitalists are seizing on the opportunity to make money off of coming catastrophes. “Record heat, dry skies, and acres of drought-stricken corn are stressing farmers and cereal makers,” a news release from the Wall Street Journal’s MarketWatch stated, “but commodities and natural resource investors are cool and composed.

“Weather has caused a ‘supply shock’ that observers say only reinforces a longer-term investing theme in the scarcity of food and water,” the business news site commented. Jeremy Grantham, “a closely followed value investor and co-founder of asset management firm GMO LLC” advised speculators to jump on land, water, and agricultural holdings because “a hungry and thirsty world is growing.” Grantham declared, “you can’t triple a population in a lifetime without consequences.”