Two-and-a-half years after the financial crash of September 2008 and two years after the official end of the US recession, it is clear that none of the underlying problems that plunged the world economy into the deepest slump since the 1930s have been resolved. On the contrary, the anemic economic recovery is faltering, growth rates are slowing in most of the world, and the financial system is once again teetering on the edge of the abyss.

The renewed rise in unemployment in the US, accompanied by further declines in home prices and sales and a retrenchment in manufacturing, is the sharpest expression of a global trend. The World Bank’s latest Global Economic Prospects report, issued June 7, forecasts slower economic growth for every region of the world except sub-Saharan Africa for this year and the next. The bank estimates that the world economy will expand by a mere 3.2 percent this year, dramatically lower than the modest 3.8 percent rate for 2010.

The US economy is expected to grow a dismal 2.6 percent this year and remain below 3 percent at least through 2013. It takes a sustained growth rate of at least 3 percent to make a dent in the near-double-digit official US unemployment rate.

Even more ominously, the bank believes the growth rate of the developing countries—China, India, Brazil, etc.—will fall to 6.3 percent through 2013, a full percentage point below the rate for 2010. These are the countries that have largely accounted for global growth since the financial meltdown in the advanced countries.

These grim projections do not take into account data from May showing a marked deceleration of growth in the US, Europe, Japan, China and India.

Recent days have seen a proliferation of warnings from bourgeois economists of the danger of a return to negative growth—a so-called “double dip recession.” Lawrence Summers, until late 2010 the director of Obama’s National Economic Council, published a column June 13 in both the Washington Post and the Financial Times in which he warned that the United States “is now halfway to a lost economic decade.” He noted that between 2006 and 2011, US economic growth averaged less than 1 percent a year, similar to that of Japan “in the period its bubble burst.”

New York University professor Nouriel Roubini warned this week of a “perfect storm” of fiscal deficits in the US, a slowdown in China, European debt defaults and stagnation in Japan. China could face a “hard landing” after 2013, he said, as a result of overcapacity in fixed investments and bank failures.

The world economic crisis was precipitated by an orgy of speculation, in which the boundary between financial wheeling and dealing and outright criminality was largely effaced. Yet the unswerving focus of government policy from the outset has been to protect the wealth of the financial aristocracy. To this end, state treasuries were plundered to cover the gambling debts of the bankers.

The multi-trillion-dollar bank bailouts inaugurated the greatest transfer of wealth from the bottom to the top in human history. This has immensely sharpened social tensions and ushered in a new period of revolutionary upheavals.

The initial stirrings have already been seen this year in the revolutionary uprisings in Tunisia and Egypt, the intensification of working class resistance in Greece and other European countries, and the mass workers’ protests in Wisconsin. The bourgeoisie has been able to loot the public treasury only due to the treacherous role of the trade unions and their allies in the pseudo-socialist “left” in undermining and strangling working class opposition.

The sharp increase in state indebtedness resulting from the bailouts has only further undermined the longer-term solvency of the banks, since they were left holding tens of billions of dollars in government securities whose value has plummeted.

The universal response of the bourgeoisie and its governments of all stripes—whether conservative, liberal or “socialist”—is to impose the full cost of the crisis on the working class. The aim is nothing less than a social counterrevolution—the wiping out of all of the social gains achieved over the past century and the reduction of the working class to a state of poverty and desperation.

But far from solving the financial crisis, all of their efforts have only deepened it. One year after receiving a €110 billion loan tied to savage austerity measures, Greece has been plunged into a deep recession, which has undermined state revenues and intensified the debt crisis. Now, in exchange for a new loan, the social democratic government is imposing even deeper cuts as well as a fire-sale of state assets.

This vicious cycle, being replicated in Ireland, Portugal, Spain and other heavily indebted countries, leads inevitably to state defaults and a new financial crisis.

Not a single leading banker has been prosecuted in connection with the massive Ponzi scheme that was erected on the basis of toxic sub-prime mortgages and other dubious assets. The giant banks have not only not been broken up or nationalized, they have been allowed to increase their monopolistic power. No serious reforms have been instituted, allowing the banks to resume their reckless speculation and take in record profits, while awarding their executives higher bonuses than ever.

The unregulated derivatives market, which played a central role in the financial meltdown, continues unabated. Untold millions in profits are being made from a burgeoning market in credit default swaps betting on the likelihood of sovereign debt defaults.

Arguing against any restructuring of Greek debt, Mario Draghi, the former governor of the Bank of Italy, who is likely to become the next president of the European Central Bank, told the European Parliament this past week: “Who are the owners of credit default swaps? Who has insured others against a default of the country? We could have a chain of contagion.”

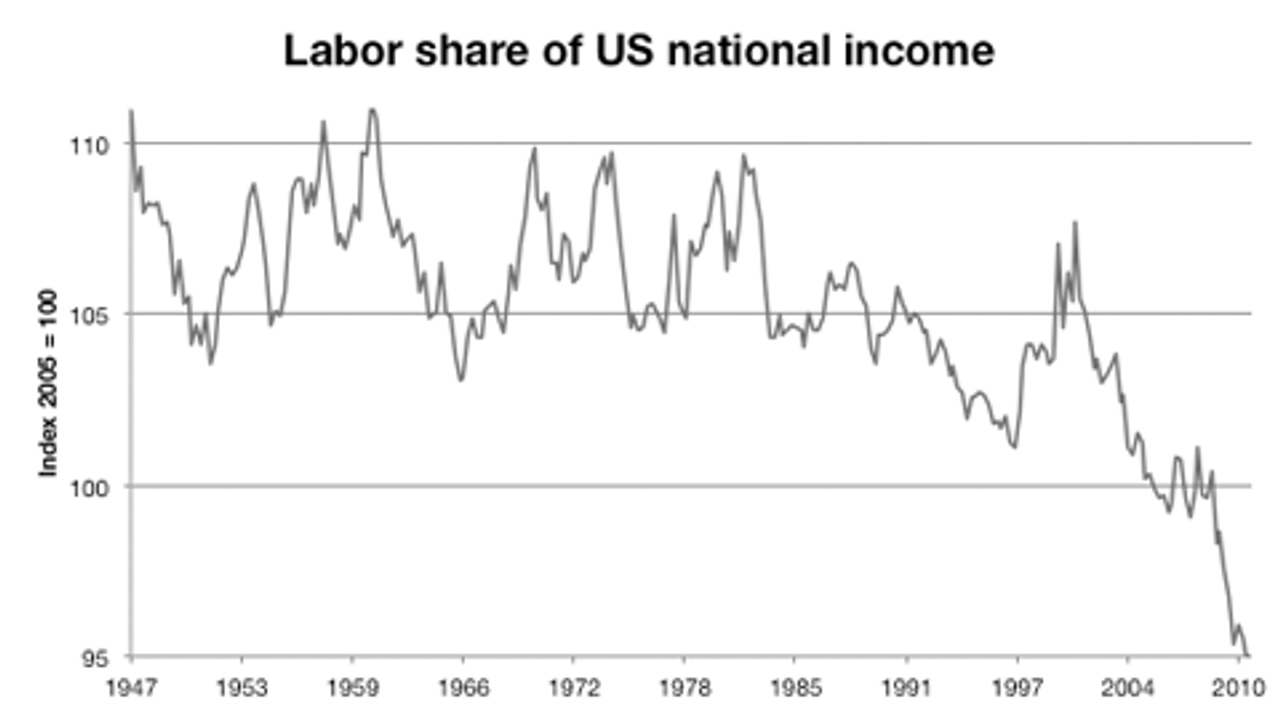

The decline in the living standards of the working class and the further concentration of wealth at the top is summed up in a staggering chart published by the US Labor Department which shows that the share of US national income going to workers has fallen to a record low.

Source: US Department of Labor: Bureau of Labor Statistics

Source: US Department of Labor: Bureau of Labor StatisticsThe chart shows that the decline—a general trend beginning in the 1980s—dramatically accelerated in 2000. What is most significant is the fact that workers’ share of national income has fallen even more rapidly during the supposed “recovery” that began in June 2009 than during the official recession.

What does this reveal? It demonstrates that the crisis is being systematically and deliberately exploited by the American bourgeoisie and the Obama administration to carry out a historic and permanent reversal in the conditions of the working class.

The events of the past 33 months have refuted all of the claims of governments, politicians, media pundits, trade union officials and academics that a viable solution to the crisis is possible within the framework of capitalism. As the Socialist Equality Party and the World Socialist Web Site explained from the outset, the current crisis is not simply a conjunctural downturn, but rather a systemic crisis of the world capitalist system. At the center of the crisis is the protracted and profound decline in the global position of American capitalism.

The SEP wrote in January of 2009, “A ‘rebalancing’ of the world economy—that is, the establishment of a new world economic equilibrium on a capitalist basis—can be achieved only through a massive destruction of existing productive forces, a catastrophic lowering of the living standards of the international working class, and, for this to be realized, the annihilation of a substantial section of the world’s population. Thus, the real alternative to capitalist disintegration is the rational reorganization of the global economy on a socialist basis.”

This perspective—and warning—has been vindicated by events. So, too, is the passage in the same document which speaks of the interrelated processes of capitalist crisis and the development of the social and political militancy of the working class and new forms of revolutionary consciousness. “The decisive question is which of these processes will gain the upper hand,” the document states.

The initial expressions of the new stage of the class struggle in North Africa and the Middle East, Europe and America have underscored the reactionary role of the trade unions, the official “left” parties and the various middle-class organizations that work to keep the working class tied to these counterrevolutionary forces.

They have highlighted the complex political problems facing the working class as it enters a new period of revolutionary struggle and have thrown into sharp relief the central question: the crisis of leadership and perspective in the working class. The deterioration in the world economy will inevitably fuel new and broader social struggles, providing ample opportunities for the revolutionary movement to fight for the leadership of these struggles and arm them with a socialist and internationalist perspective.

The Socialist Equality Party and the International Committee of the Fourth International alone are capable of and determined to provide this leadership. All those who see the need for a socialist alternative to poverty, dictatorship and war should make the decision to join and build our movement in every country.

Barry Grey

The author also recommends:

Perspectives and Tasks of the Socialist Equality Party in 2009

[13 January 2009]

We will follow up with you about how to start the process of joining the SEP.