Manufacturing in the US is collapsing, with a key index falling to its lowest level in 20 years on Friday. Other figures released yesterday show a downturn in production throughout the world.

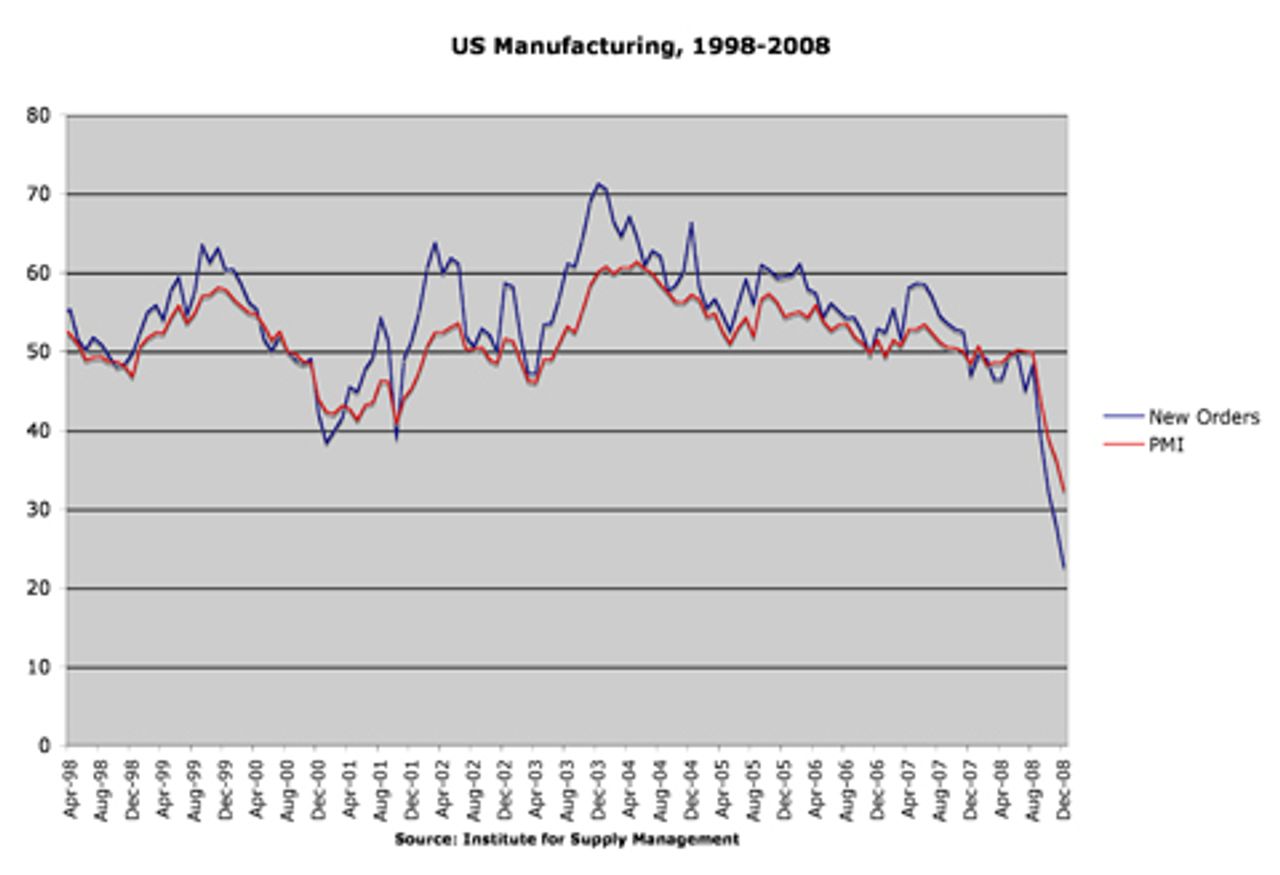

The Institute for Supply Management reported that its key index, the Purchasing Managers Index (PMI), fell to 32.4 in December from 36.2 in November. Economists had expected a much slower decline to 35.4. It is the lowest reading of the index since June 1980. A figure below 50 indicates contraction in manufacturing.

Norton Ore, chair of the ISM Manufacturing Business Survey Committee, reported, "The decline covers the full breadth of manufacturing industries, as none of the industries in the sector report growth at this time. New orders have contracted for 13 consecutive months, and are at the lowest level on record going back to January 1948." Prices also fell the most since 1949.

The institute's production index, a component of the PMI, fell to 25.5 from 31.5, and its employment index fell to 29.9 from 34.2. Most components of the overall PMI index have been declining at an accelerating rate over the last several months.

These figures herald a period of continued hemorrhaging of employment in manufacturing, which shed over 600,000 jobs in 2008.

Separate figures show similar trends in other countries. An index for Europe derived from a survey of purchasing managers by Markit Economics fell from 35.6 in November to 33.9 in December, the lowest level since the index was begun in 1998. The new orders index fell to 26.4 from 28.8 in November.

Figures released last month showed that industrial output in France, Italy, Sweden and Greece fell in October, including a 7.2 percent fall in France. These figures are sure to be worse in November and December.

Germany is also in sharp decline. Last month Casten Brzeski, Europe economist for ING bank, said that the fourth quarter will "very likely make history as the worst collapse of the German industry ever." German GDP contracted by 0.5 percent in the third quarter, and likely contracted by much more in the fourth.

Meanwhile, the China Purchasing Managers Index rose slightly to 41.2, from a record low of 40.9 in November. However, the figure is still far below 50, signaling continued contraction in Chinese manufacturing as exports collapse.

Chinese businesses are responding to the economic crisis through mass layoffs. According to CLSA, which calculated the index, "Chinese manufacturers reduced the size of their workforces at the fastest rate recorded by the series to date." The employment index has fallen for five straight months.

A Purchasing Managers Index for Russia fell to 33.8, 6 points below its reading in November. According to Bloomberg, "That is lower than at any time during the 1998 economic collapse, when the government dropped its support for the ruble and defaulted on $40 billion of domestic debt."

The Russian economy is in a state of freefall, due in part to the rapid decline of commodity prices in the second half of last year. The Russian stock index RTS fell 72 percent in 2008, and the central government is rapidly using up the country's foreign currency reserves. Russian industrial output contracted by 8.7 percent in November, the largest fall in 10 years.

The manufacturing index figures open 2009 with a sign of what is to come: a global economic slump on a scale not seen since the 1930s.