Dire conditions in a once prosperous East Side Detroit neighborhood underscore the impact the wave of home foreclosures is having on working people across the United States. While the effect of the mortgage crisis on the Wall Street banks is headline news, the media rarely inquires into the social consequences of the foreclosure epidemic.

Some three-quarters of a million people have lost their homes across the US so far this year and foreclosure filings are up 82.6 percent from a year ago, according to the web site ForeclosureS.com. The same report notes that 107,500 homes were lost in September alone.

The city of Detroit has the highest repossession rate for a major city in the US, with real-estate owned (REO) homes—that is, homes repossessed by banks or mortgage holders—at 3.7 percent in 2007. Cleveland, Ohio came in a close second with a 3 percent REO rate.

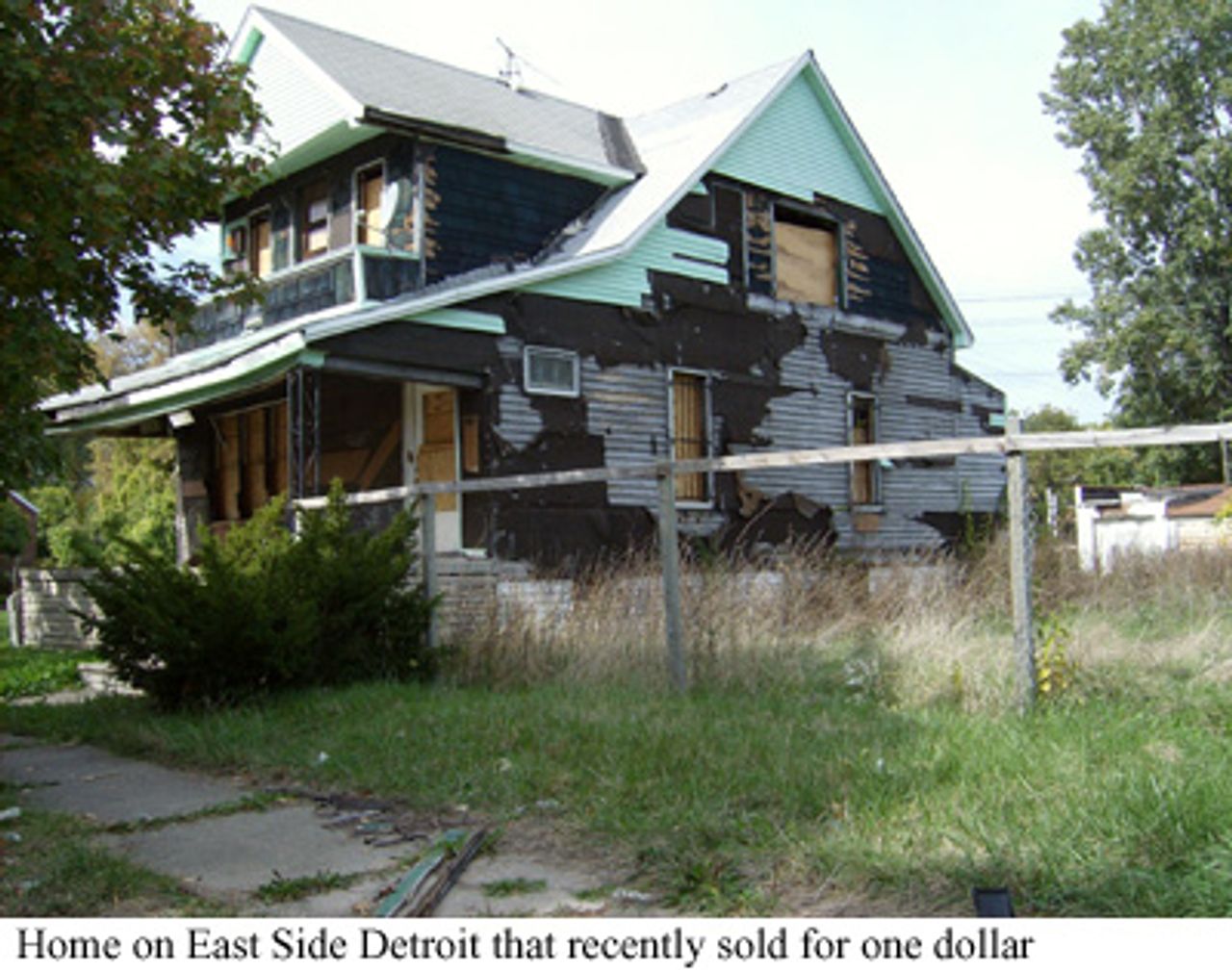

The social reality behind these figures is illustrated by a recent sale of a foreclosed home in Detroit. In September, a modest two-story single-family home on Detroit's east side near the Detroit City Airport sold for one dollar. Less than two years ago, in November 2006, the same home sold for $65,000.

While abandoned homes are hardly a new phenomenon in Detroit, the story of this one house is a testament to the speed, scope, and depth of the foreclosure crisis. The one-dollar sale of the Detroit house even made the Sunday Times of London, which recently ran a piece titled "America's Darkest Fear: to end up like Detroit."

"We finally came out to see what it was about, why the news trucks were here. It took three days before they finally came to us and asked the people on the block what they thought. I don't think they really care about people like us and what we think."

Prior to the collapse of auto manufacturing in Detroit, the neighborhood had been relatively prosperous and home to thousands of autoworkers. Now, foreclosed properties are lowering home values and causing urban blight throughout the area. Constance rents a house on the same street as the foreclosed home and grew up nearby.

"I heard about the house up the street selling for one dollar," Constance told the WSWS. "They had just fixed it up real nice a year and half ago, new siding, things like that. It looked beautiful. Now it's a mess."

Last summer the bank foreclosed on the home after the owners fell behind on their mortgage. "They had some renters come in and then it was empty. It didn't take long for them to come and strip the place clean," Toshiana said.

"When I was a baby my father was at an auto plant," Constance added. "He had a brother working at the plant also. I had another uncle who worked at Dodge Main in Hamtramck. They all came up from the South in the early 1970s. There are not many people around here at the plants anymore. My mother says she is leaving Michigan and moving back to Louisiana as soon as she retires."

The term "toxic mortgage" only begins to describe the effect of the housing crisis on working class communities across the US. The family that falls behind on mortgage payments or rent is out on the street. Neighborhoods become distressed. Abandoned houses catch fire and burn—a common phenomenon in Detroit—producing a noxious odor that permeates whole neighborhoods for months.

Toshiana noted the absence of the most basic services in the city of Detroit. "We don't even have a grocery store anymore."

She continued, "You actually have to go back to the early '90s to see when all this started to happen. I could tell you a couple blocks I lived on in Detroit that I watched gradually torn down. They were really nice when I was there, but what happened? One place, I came back five years after I had moved, just to visit. I could not believe what had happened. The place was a mess; the houses were in terrible shape.

"Look around here. All you see are empty lots. Realtors may call these an investment opportunity, but who wants to live next to an empty lot? Scrappers make money off tearing the houses up. I really don't understand why they even give out junking licenses, when they know this is going on in the neighborhoods. The decline is very ugly."

"My 14-year-old son could buy a block of Detroit property," said a representative of the realty management firm that sold the one-dollar house.

Foreclosures are rising in several metropolitan areas across the state of Michigan. According to figures released by RealtyTrac, the state as a whole ranked fourth nationwide in the total number of foreclosure filings in August, with 13,605. Foreclosure filings rose 17 percent over July levels. Michigan ranked fifth nationwide in foreclosure filings, with one for every 332 households. That compares with a national rate of one filing for every 416 households.

A 2006 Association of Community Organizations for Reform Now (ACORN) report, "The Impending Rate Shock," singled out Detroit as one of the cities likely to experience a housing disaster. In 2005 more than half the home purchase loans made in Detroit were high-cost loans, "making the city particularly vulnerable to rate shock," the report noted. There were 23 metropolitan areas in the US where high-cost loans represent at least one of every three loans made to homebuyers.